Inefficiency of CAPM

- MSE Research Cell

- May 9, 2018

- 5 min read

Author: Rana Sundaram

Capital Asset Pricing Model (CAPM) is a set of predictions concerning equilibrium expected return on risky assets. It gives a precise prediction of the relationship that we should observe between the risk of an asset and its expected return. It provides a benchmark rate of return for evaluating possible investments and also helps us to make an educated guess as to the expected return on assets that have not yet been traded in the marketplace.

CAPM model is based on the Markowitz selection model. Markowitz selection model explains the optimal risk portfolio for one investor. If all investors follow Markowitz selection model then everyone will be holding a combination of a risky portfolio and a risk-free asset and no risky asset is left unheld. As optimal risky portfolio consists of all risky assets, hence asset prices will adjust in such a manner that it will follow and equilibrium model and that model is known as CAPM.

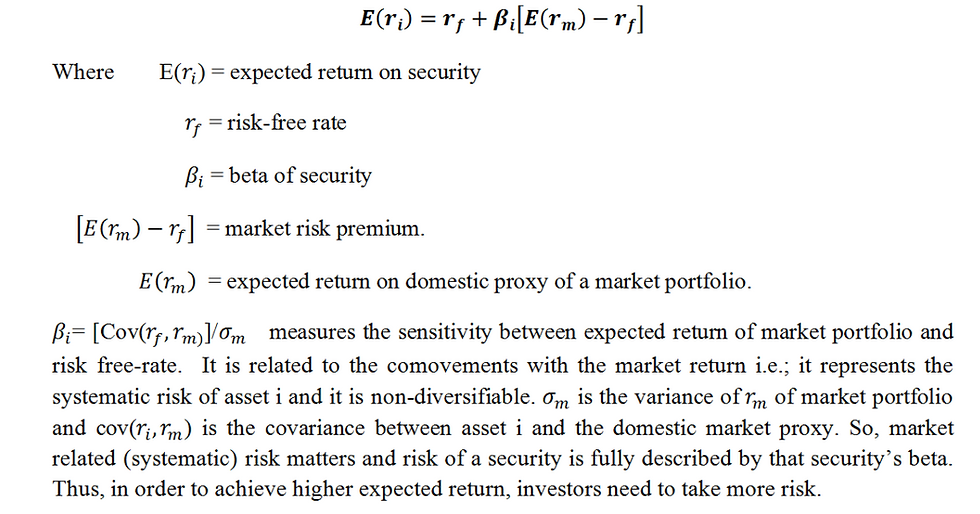

The expression for CAPM is:

CAPM is based on certain assumption.

1: Investors are rational and mean-variance optimizers.

2: Their planning horizons is of single period.

3: Investors have homogenous expectations.

4: All assets are publicly held and traded on public exchanges, short positions are allowed and investors can borrow or lend at a common risk-free rate.

5: All information is publicly available.

6: The is no taxes and no transaction cost.

Now, according to efficient market hypothesis (EMH) stock prices correctly reflects all available information about the stock. A forecast about favorable future firm performance will lead to good current stock return. A prediction of good future earnings will make investors buy the stock today and hence price goes up immediately, because then everyone will be demanding more.

Stock prices only respond to new information and this new information is unpredictable, (if it could be predicted then the prediction would be part of today’s information.) Hence stock prices follow a complete random walk. EMH relies on investors gathering information and making informed trades. Strong competition for higher investment return assures prices reflect information.

Efficiency Check

So, the question that arises is whether the prices are informationally efficient and is it the case that investors are only rewarded by bearing systematic risk?

Before answering these questions let us first understand about security market line (SML). SML graphs individual asset risk premiums as a function of assets risks. The SML provides the required rate of return necessary to compensate investors for risk as well as the time value of money. Hence it measures the linear relationship between beta of a security and its expected

which is reflected or maybe due to behavioral bias or maybe trading frictions, etc or CAPM is not sufficient. If market is efficient and is on average correct then we would expect that the expectations of investors will not change very sharply, but when we look at stock market crashes we can see that the expectations of investors can change sharply. Hence market is not efficient and CAPM does not adjust for risk efficiently. If we can predict returns to a certain degree of accuracy for a fairly large number of stocks, then that means all correct information was not reflected in the price of the stock, and hence EMH will be violated. So, there will be abnormal returns.

We usually have to adjust for portfolio risk before evaluating the success of an investment strategy. CAPM can be used to adjust for risk. However, we know that even if beta is a relevant descriptor of stock risk, the empirically measured quantitative trade-off between risk as measured by beta and expected return differs from the predictions of CAPM. Now if we use CAPM to adjust for portfolio returns for risk, inappropriate adjustments have to done and that may lead to the conclusion that various portfolio strategies can generate superior return, when in fact it simply is the risk adjustment procedure that has failed.

Under the framework of computational econometrics, the two-step regression procedure is used to estimate the CAPM, concluding that the slope of the SML is different from the slope of SML indicated by CAPM. This finding of econometrics analysis gave an idea that the CAPM has not a statistical significance in portfolio selection. Fama & French (1992) noticed that CAPM suffers from endogenous inabilities and found very little relation between expected returns and beta. Many researchers accepted the partial validity of CAPM hypothesis regarding the beta, whereas, many other surveys find lacks in the model and a statistically insignificant beta, concluding that CAPM is not an effective investment method and beta is not important. However, Alexander and Francis (1986) noticed that empirical data cannot easily be used to verify the CAPM for two reasons:

1: CAPM states that expected returns are determined by risk. However, expected returns are not observable which implies that the test of the CAPM must be concluded using historical returns.

2: There is only one potentially testable hypothesis associated with CAPM, which is that the true market portfolio is a mean-variance efficient portfolio. Nevertheless, this hypothesis cannot be tested since the true market portfolio cannot be observed. The reason is that the market portfolio must include all assets many of which are unobservable.

It has been found that the estimated slope of the line relating average return and risk is lower than the slope of the CAPM line which relates expected returns and risk. The seminal works of Roll and Ross (1994) and Shmuel Kandel argued that the problem is not in the model but in our inability to identify efficient proxy portfolios. Diacogiannis & Feldman (2009) showed that a theoretical zero relation between expected return and beta may occur where the CAPM is not well defined.

Another reason why CAPM is not efficient is because of it assumptions. A model is robust with respect to its assumptions if its prediction are not highly sensitive to the violation of the assumptions. If we use only assumptions to which the model is robust, the model’s prediction will be reasonably accurate despite its shortcomings. But the CAPM assumptions are identically invalid. The motivation for invoking restrictive assumptions is clear since we simply cannot solve a model that is perfectly consistent with full complexity of real-life markets. However, we recognize that we have simplified reality way too much.

If we look back to our assumptions we can see that assumption 1 assumes “investors are rational” so, when investors exhibit “irrational exuberance” about an asset and as a result prices rise above intrinsic values, rational investors will take short positions thus holding down the price. But with effective restrictions, short sales fail to prevent prices rising to unsustainable levels that are precursors to a correction or even a crash. This really defines a “bubble”.

Assumption 4 and 6 in combination with 2nd assumption create a major challenge to the model In reality, we cannot even observe all the assets that are traded. To apply CAPM in reality is near to impossible. The assumption 1 that a large number of investors are mean-variance optimizers is critical. It is having very thin line in the sense that if a security is mispriced, then investors will tilt their portfolios toward the underpriced/overpriced and away from the overpriced/underpriced securities respectively. Pressure on equilibrium prices results from many investors shifting their portfolios, each by relatively small dollar amount. CAPM is not even completely testable because it relies on an unobserved, all-inclusive portfolio. It should be noted, however that when we replace the unobserved market portfolio of the CAPM with and observed, broad index portfolio that may not be efficient, we no longer can be sure that the CAPM predicts risk-premiums of all assets with no bias.

Conclusion

Capital asset pricing model is one of the most important tool in finance that helps financial managers in deciding the optimal market portfolio. But as every coin has 2 sides, so does CAPM. Although CAPM is theoretically very sound but in empirical finance it does not hold any water. CAPM is cannot be tested and very frequently it has been proved that it is an inefficient tool on the basis of empirical analysis. But given its limitations we cannot deny its power in explaining how a market portfolio should be designed and what will be the efficient allocation of resources between various assets.

Comments